Let’s talk about UX in Self Custodial Wallets

8 mins

Last Edited: Jul 07, 2023

Share

Let’s talk about UX in Self Custodial Wallets

In this digital age, where cryptocurrencies and decentralized finance (DeFi) are gaining momentum, self-custodial wallets play a pivotal role in empowering individuals to have complete control over their digital assets.

Web3 Wallets

Okay so self-custodial wallets, simple, secure and privacy focused; oh wait let’s scratch the simple out, they are certainly not simple, just yet. If you’re unaware about self-custodial wallets then here’s a great explainer article.

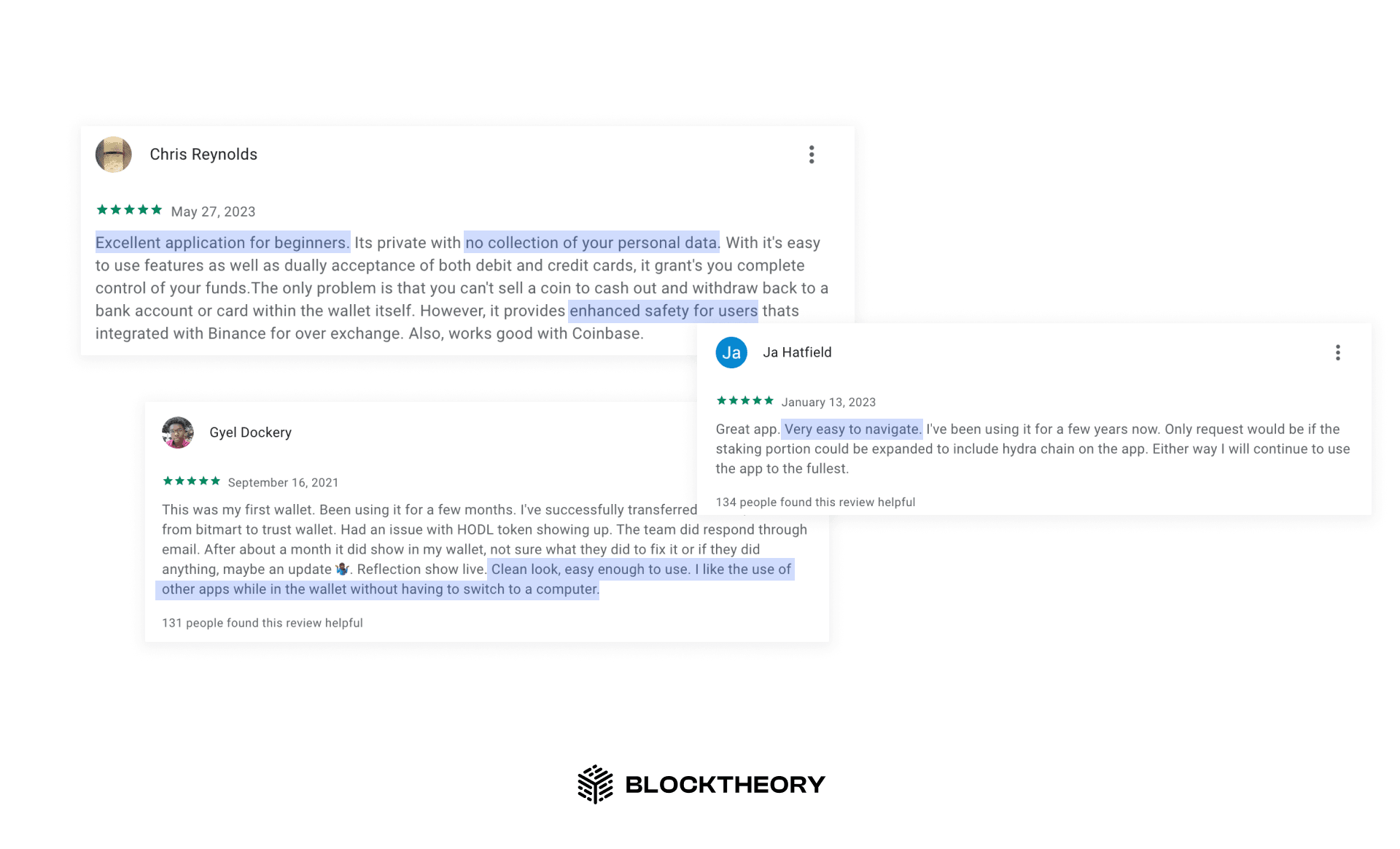

Undeniably, wallets have become the backbone of the crypto industry, and besides your usual day to day regulation changes, over engineered tech, and a billion new tokens and chains, UX has become a key differentiator between what stays and what doesn’t. Don’t believe us, then take a look for yourself-

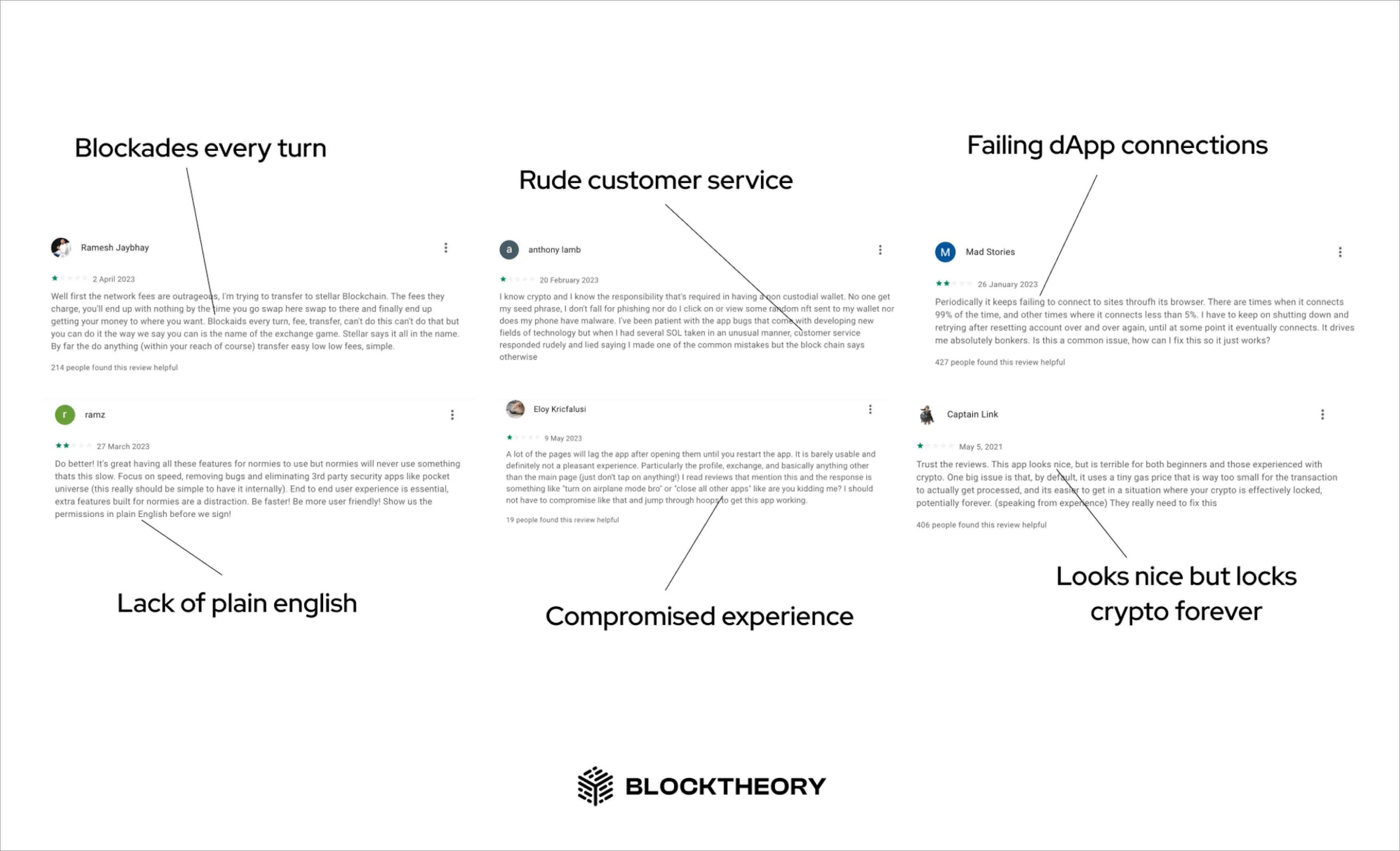

Few of the many reviews which some of the biggest self-custodial wallet apps have on Google PlayStore

🗺️ The self-custodial wallet landscape in 2023

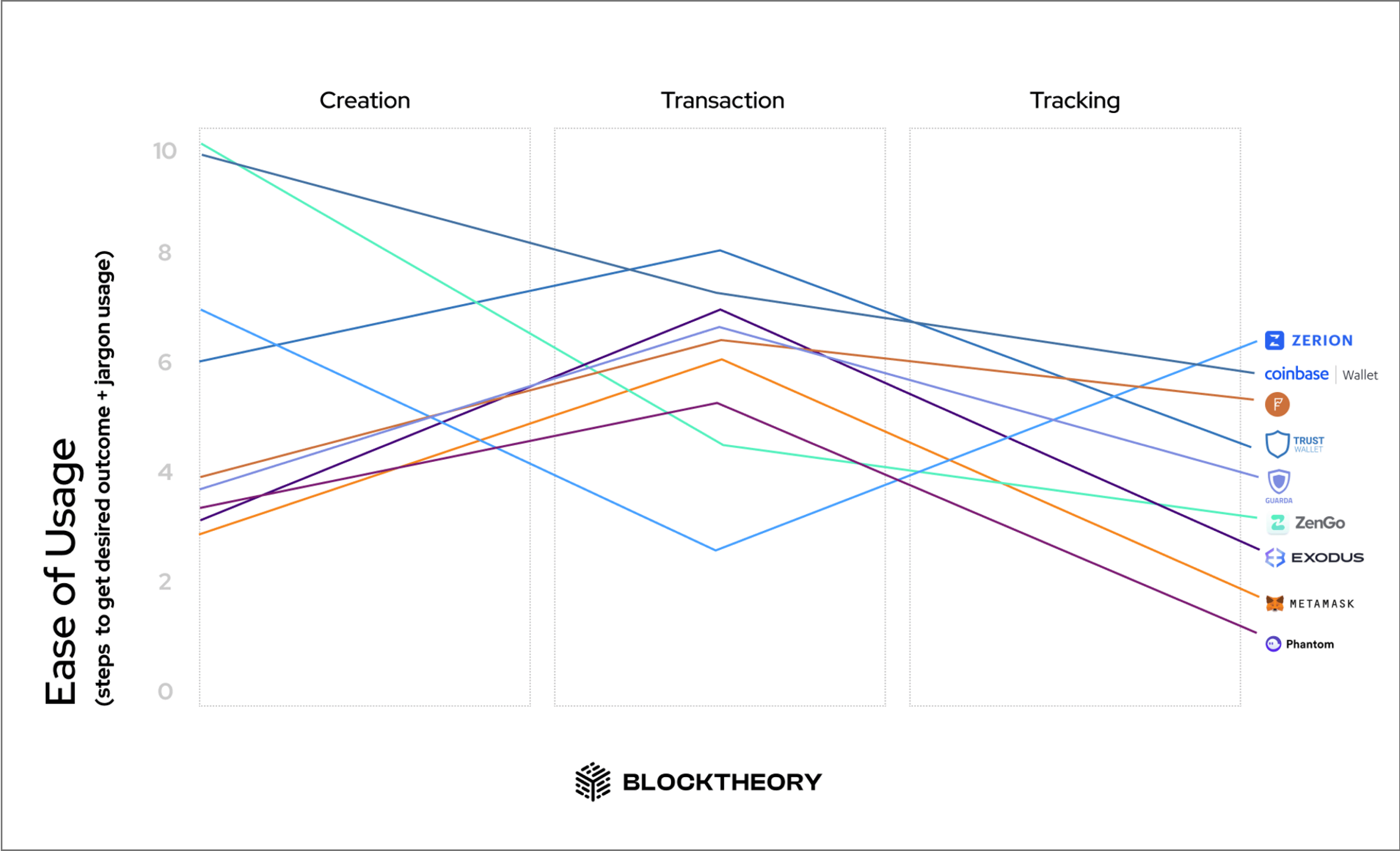

To better understand the UX challenges, we’ve tried to score some of the most popular self-custodial wallets in the key user journeys wrt ease of usage and here’s what we found

We’ve scored these apps relative to each other based on our experience using them as well as by gauging the majority ratings in the playstore feedbacks.

As is clearly visible, each of these apps is focusing on solving specific sections but none of them have made the entire journey seamless, yet.

Another interesting stat is to observe the average ratings of legacy wallets (metamask, phantom, coinbase, trust & exodus) vs the newer ones. This is important because the legacy wallets had the first mover advantage and onboarded a huge number of users whilst making things just work but neglecting the overall experience (exception trustwallet & coinbase). These products have influenced the design of most wallets and targeted people who already understood the complexities of crypto.

The user was given significant power and responsibility with little to no context.

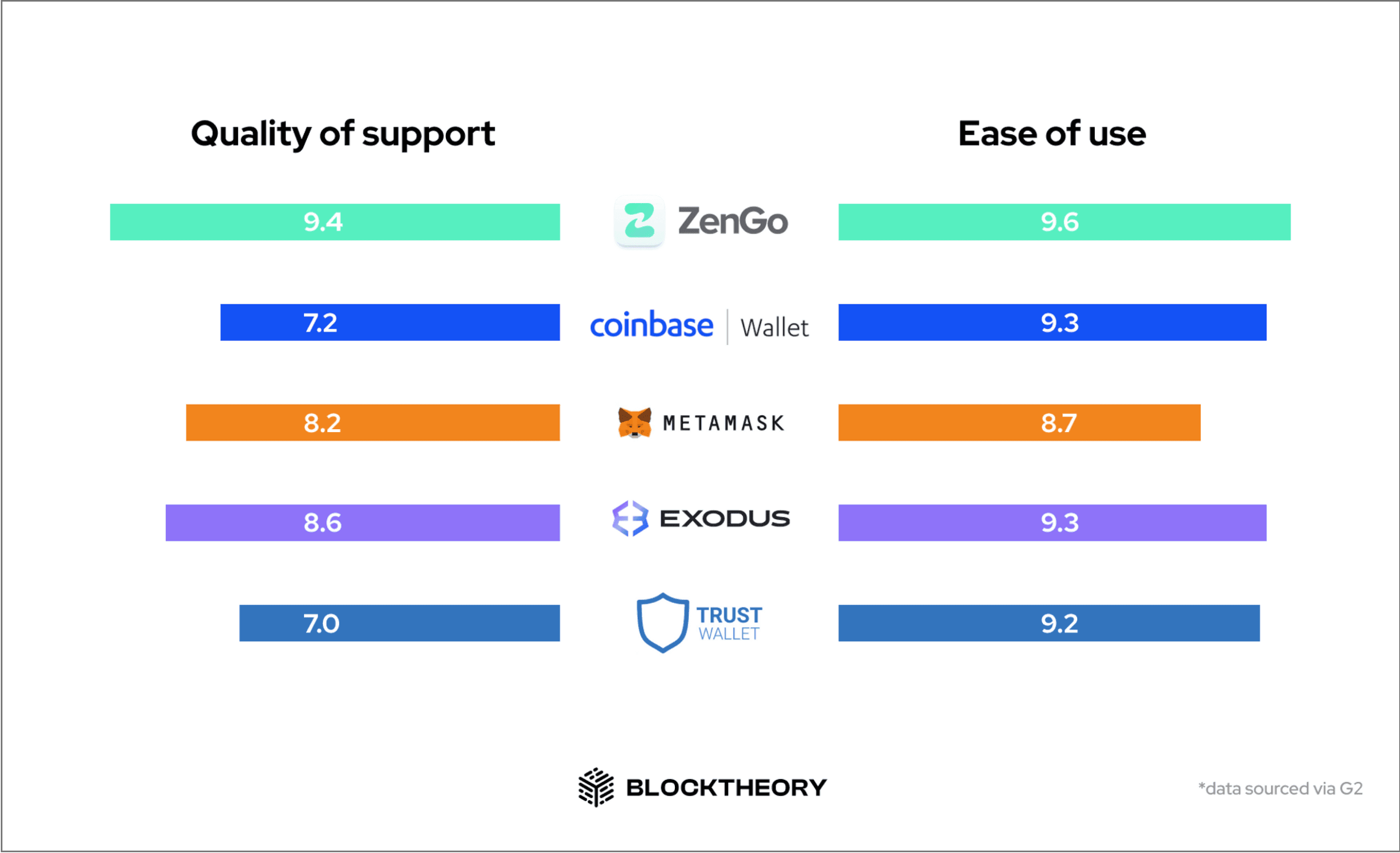

G2- Best Cryptocurrency Wallets

This website aims to capture a large map of over 147 crypto wallets and rates them on 2 factors

- Quality of Support

- Ease of Use

Well this suggests that the average crypto user considers a good experience only when both criteria are met of a satisfying support desk as well as an easy to use platform.

To be fair, as products grow larger, offering support on a case to case basis becomes significantly more difficult thus decreasing the overall satisfaction levels. But this is just one study and it doesn’t paint the overall picture.

We picked some of the most popular ones and here's how they fared. An important note is that this is not an exhaustive scoring system and relies on user feedback so it is not absolute.

Google Playstore & Chrome Webstore

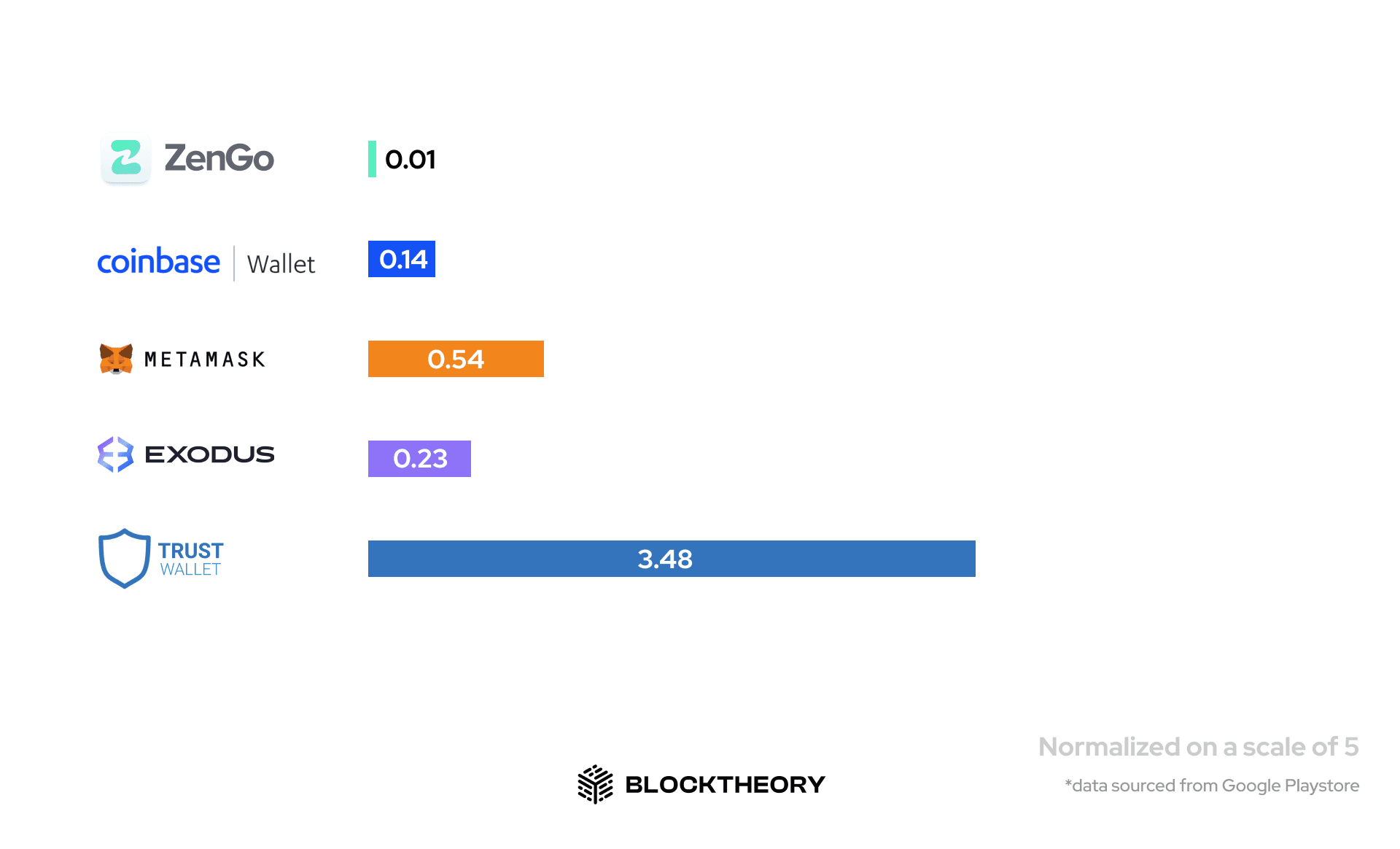

The majority audience tends to leave feedback directly at the market places, so we took the same apps and tried to create a normalised distribution to see if it correlates with the G2 study

This is an interesting outcome and here’s why Trust wallet beats all the others by a huge mile. Trust has managed to get 4.4⭐️ from over 1.5M users! Compared to Metamask & Exodus which have gotten 4.6⭐️(220k users) & 4.5⭐️(98k users) making it one of the highest rated self-custodial wallets out there.

If you’re interested to know the exact procedure of how this was calculated, checkout this

What did trust do that went right? That’s something that needs to be unpacked in a separate article altogether but in short here’s the answer

User reviews of Trust Wallet on Google Playstore

Let’s summarise the self-custodial wallet landscape in 2023

- There are approximately over 240 listed self custodial wallets in the Android and Chrome market place in 2023

- Most wallets have built extensively to make transactions smoother but very few have cracked the creation step of the user-journey. Sign-up flows to create and import wallets are currently riddled with challenges for users.

- It is clear that for a product to be mass-adopted it needs to make sure that it balances the equation of ease of usage along with a good support system on the user end.

🏦 Learning from the evolution of banking in web2

The idea of DeFi was built on solving problems faced in the TradFi systems. Although these systems themselves have weathered many more difficult challenges and have found some creative solutions. Hence referencing these could give us a potential breakthrough or help us identify mistakes we’re repeating here.

Digital banking was revolutionary as it made physical banking obsolete followed by neo-banking which is currently attempting to one up digital banking. If you are unfamiliar with these terms then here’s a great article which covers the evolution of digital banking.

Deloitte's study on the digital banking momentum

A very interesting study conducted by Deloitte surveyed people from a very diverse age range and here’s what they found-

- Younger consumers prefer both physical and digital channels, but are less satisfied with their primary banks and more likely to switch.

- They also seek innovative services offered by neo-banks, including automated spending insights, P2P payments, and "get gas" and "get food" buttons that find and pay for the nearest gas station and restaurant.

- Banks should consider positioning mobile apps as the central platform for their consumers’ various banking needs instead of their branches. Acting as the hub of interconnected experiences, these apps can help integrate the banks’ otherwise siloed channels and become a go-to tool for consumers.

Revolutionary Payment Infrastructures

Another great reference point is to see how web2 products tackled large scale problems to scale some payment models, which are no short of revolutionary:

UPI & Alipay

- India’s UPI (Unified Payments Interface) and has acquired over 300M monthly active users in less than 7 years. This is a major achievement as the rural-urban penetration of this technology has been almost at par. At it’s core it relied on simplicity. 1 QR code per person/business and 1 scanner to connect these two entities.

- Similar to UPI, Alipay is a much older platform with over 1.3B users and it relies on similar strategies of onboarding consumers and producers on 1 aggregated platform with its robust tech having a simple intuitive end user interface

🎯 The takeaway is how products can cut down their reliance on their user to understand the technicalities and jargon of payments and to focus more on making it intuitive and human

Apple pay

- Apple launched it’s payment platform back in 2014 backed by its already huge network of devices

- Building essentially a wallet app that housed all your cards, it instantly made every single iPhone user a digital payment interface without any additional effort.

🎯 The takeaway is how a product can seamlessly integrate into the current infrastructure for maximum adoption without much effort from the user’s end

The banking industry experiences frequent disruption due to complacency and a lack of empathy towards its users. Neo-banks have successfully empathized with consumers and offered modern technologies and conveniences, leading to continued customer inflow. This pattern is now also observed in the crypto markets.

👀 Looking at custodial wallets and their patterns

Custodial wallets promise the perks of crypto along with the ease of usage of web2 banking. The only caveat they have access to your keys and any points of failure within the system would take your money down too, like in the case of the FTX crash.

What used to make custodial wallets such a hot avenue for crypto traders is no longer the case as self-custodial wallets are catching up in terms of usability but there are still features (like wallet recovery, device cross-compatibility) which need to be migrated into the self-custodial ecosystem to make them as popular as these centralised ones.

43% of Trust Wallet users use centralized exchanges to store their crypto holdings, while the remaining 57% self-custody most of their assets on Trust Wallet.

🎯 Product builders must make significant improvements in account abstraction, easier wallet recovery and sign-in, and on-ramp flows to make self-custodial wallets the default choice. Issues of transaction speeds and high failure rates need to be fixed to compete with big custodial players.

🤔 Right so why hasn’t someone already figured it out?

Well to be honest, this isn’t as simple as it seems and a lot of products out there are now more aware about this situation and are trying out various approaches to make it big. Some of the biggest breakthroughs will be in the direction of account abstraction with tech like MPC making wallet recovery flows simple and reducing the chances of locked crypto.

Going the Apple Way…

Apple knew that to appeal to the widest possible audience it would need to keep its product line super simple and that could even mean axing some obvious features at the stake of make the core features more intuitive. For example-

Whilst android users boasted about widgets and customisation from the beginning, iPhones continuously outperformed them as they usually were the no-brainer pick if a phone was to be recommended right from a 8 to an 80 year old.

This meant that apple knew how to empathise with the most diverse audience and it has continued to do so even now.

The impact of a self-custodial wallet being done right will be no smaller than Apple launching the first iPhone in 2009, causing significant downstream effects into how crypto wallets will be designed and which portions of UX will be prioritised.

🔑 Key Takeaway

The takeaway is how a product can seamlessly integrate into the current infrastructure for maximum adoption without much effort from the user’s end