We read the best Web3 reports of 2023 and compiled the highlights so you don’t have to (Here’s...

8 mins

Last Edited: Oct 18, 2023

Share

We read the best Web3 reports of 2023 and compiled the highlights so you don’t have to (Here’s all that you need to know)

Get in depth insights on the Crypto market via quarterly compiled Web3 reports

Advanced

Reports

Overview

As 2023 comes to its final quarter, we thought it would be an amazing idea to summarise some of the best Web3 reports out there on the latest happenings. Right from cryptocurrencies DeFi to the most hyped upcoming use cases, we've tried to list them all in short, digestible bullets.

We'll cover the market perspective, including the big crashes of '22 and the performances of cryptocurrencies. Trends on the Ethereum merge, and its impact, institutional investors' preferences, V.C. behaviour patterns for 2023, layer-2 scaling solutions, and NFTs are all included.

Next up, we’ll also cover global regulations and specific updates from countries like the US, UK, Hong Kong, and the EU. Lastly, we further explore the biggest developments in 2023, including new application-specific blockchains, rollups, corporate involvement in web3, game-fi, developer activity, and regulatory news.

In order to better understand how 2023 fared for crypto, it is key to understand how it was setup in 2022 because Web3 heavily relies on momentum.

So, how was 2023 setup from a general market perspective for Web3?

- In short, not very good

- 3 big market crashes (Terra in May '22, FTX & BlockFi in Nov' 22) occurred, which impacted the overall market-cap of crypto to fall by 64% in 2022 vs 2021

- While this dropped the liquidity from $2.2Tn → $0.8Tn, the overall industry performed in-line with NASDAQ and other global indices when compared via the Sharpe Ratio of risk-adjusted returns, this was good news.

- A key trend predicted was that institutional investors would select digital assets based on factors like sustainable tokenomics, ecosystem maturity, and relative market liquidity, thus giving the edge to O.G.s like Bitcoin and Ethereum and while this was mostly true, investors also rallied on stablecoins USDT, USDC & BUSD to seek refuge from the bear run.

Interestingly, bluechip tokens (BTC, ETH) had outperformed US bonds and stocks significantly even during the crypto winter

- Stablecoins shed $27.3 billion despite their increased dominance; USDT saw a decline in market cap of 16% ($12B). Conversely, USDC & BUSD each saw similar growth of ~$2B.

- Layer-2 scaling solutions were set to be the next big thing that would disrupt the market in 2023 with their promise of low fees and faster transactions, therefore making Ethereum the go-to base chain for new products.

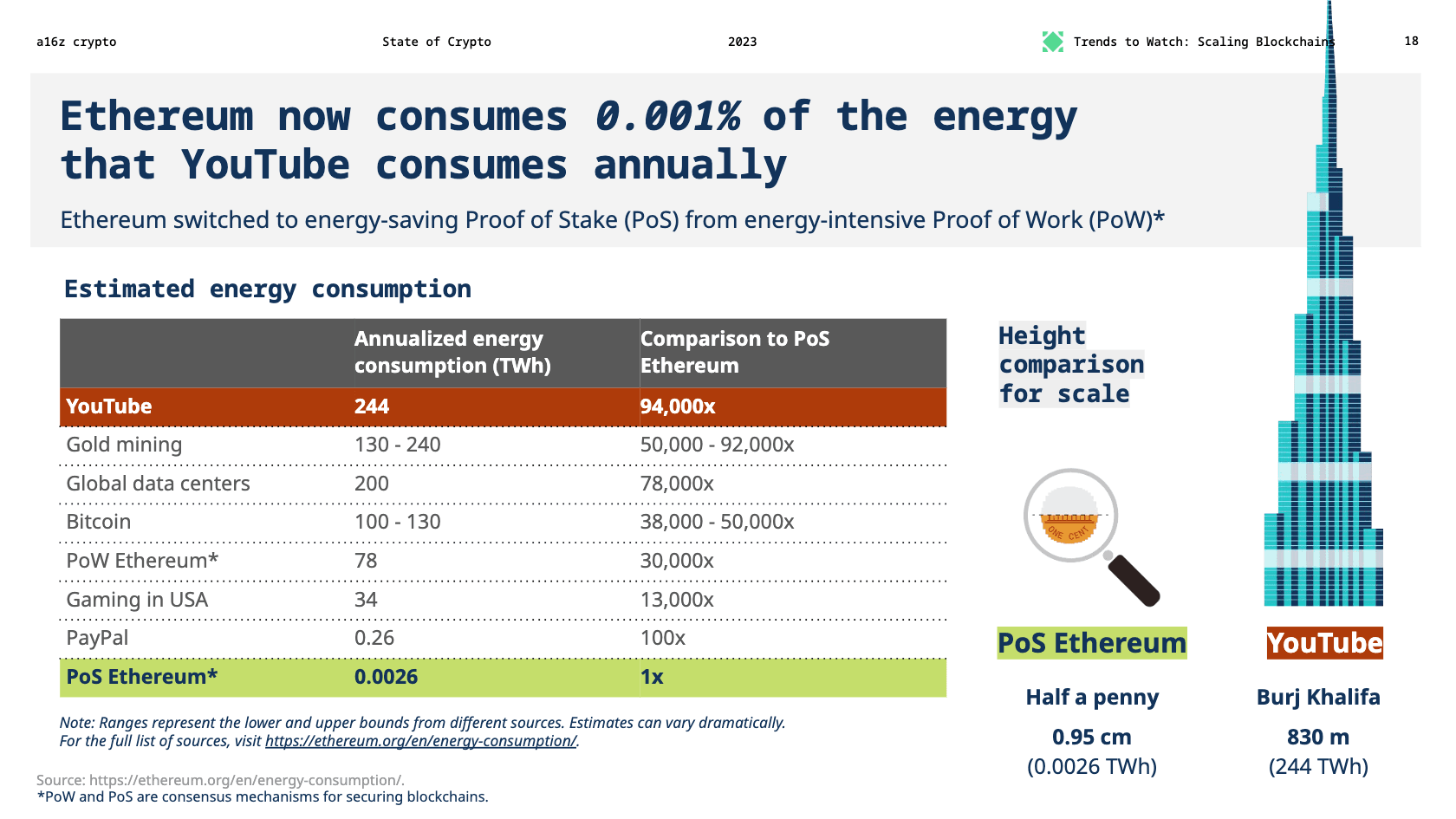

- The successful Ethereum merge drastically reduced energy usage in Ethereum transactions by over 99%, addressing environmental concerns related to blockchain technologies.

Here’s a great infographic to understand the significance of why the merge was such a big deal! / Image: a16z web3 report

- The NFTs industry underwent a healthy correction mainly due to the skeptical atmosphere, but the overall industry was hopeful of cracking newer use cases in 2023

- Lastly, a key thing is the overall regulations that law-makers across the globe imposed on the industry in 2022 and the planned developments in 2023

- In 10 of 20 G20 countries, representing over 50% of the world's GDP, cryptocurrencies are fully legal. Regulation is under consideration in all G20 countries.

- Consumer protection rules are lagging. Only one-third of the countries reviewed have rules in place to protect consumers.

- Of the 45 countries analyzed, over 90% have active central bank digital currency (CBDC) projects in addition to cryptocurrency regulations.

- Country Specific Regulation Updates

- US had a bipartisan approach, with congress divided on its views on cryptocurrencies. While it has people on extreme ends of the spectrum, an overall board has been set up that is actively creating regulatory frameworks on how new companies are established and how they can be kept in-check.

- U.K.'s House of Commons, in Oct '22, voted to give H.M. Treasury (HMT) the power to make crypto-assets a regulated financial instrument

- Hong Kong continues to lead global research and testing of a potential wholesale Central Bank Digital Currency (CBDC). In September 2022, the HKMA announced it would start paving the way for a possible implementation of the e-HKD through a 3-rail approach.

- E.U.'s MiCA (Markets in Crypto-Assets Regulation) was all set to enter into force in 2024 based on its clearance in the European parliament in early 2023

Overall, 2022 was a hallmark year for the industry as it pushed us into an extremely bearish market.

2023, therefore, was set up to become one of the toughest crypto winters for new entrants to survive while also giving enough room for tech to scale and let the corrected market recover itself.

And with that, onto 2023.

Quarter-wise Highlights of 2023

Q1 ‘23

- The CAGR of key metrics like Marketcap, General Interest, Developer Activity, and Number of Projects have all steadily increased despite the setbacks.

- Q1 had an extremely strong starting with almost 50% ($0.4Tn) of the lost market cap recovering.

- The Play-To-Earn (P2E) sector also saw a rather strong recovery, with 3 of 5 top tokens – WEMIX (+286%), IMX (+196%), and MANA (+98%) outperforming BTC.

- Besides building blockchains solely as ledgers for financial records, new application-specific blockchains have taken center-stage, like zksync, cosmos, optimism and polygon, which are laser-focused on specific use cases.

- 2 noteworthy product launches happened at the end of Q1 in the zero-knowledge (zk) space, namely zkSync Era & Polygon zkEVM; more on this in Q2

- BTC outperformed all other asset classes (Crude oil, Gold, NASDAQ, TLTs, Major Currencies) by a huge margin

- Lido Finance leads the Ether Staking DeFi Space with nearly a third of all transactions on its platform, followed by Coinbase and Kraken.

- Liquid Staking($4.2B) had the highest QoQ % Change (+210.9%) and overtook lending to become the 3rd largest DeFi category after DEX's ($11.7B) and Oracles(~$5B)

Spot trading in DEXs grew by 18%, thus making DEXs grow faster than CEXs by almost 2x

Q2 ‘23

- Rollups were the latest advancement and the talk of the town in Q2. These claim to be pre-packaged services primarily built on layer-2 solutions which assist in offloading transactions from layer-1 and make them lightning quick and almost gasless.

- As of now 7% of Ethereum’s fees are being paid via L2 rollups and this percentage will soon skyrocket as demand increases.

Zero Knowledge or ZK is the latest tech proposed which will enable chains to process more transactions per second and the tech advancements in this field are supposedly improving at Moore’s Law like pace (growing at 2x every 2 years)

- zkSync Era's TVL nearly 7Xed between Q1 & Q2, showing the amazing promise in zk tech.

- In the stablecoin space, USDT has regained its #1 position with a 66% market share. BUSD continues to drop to < 3%.

- Overall, in Q2, crypto companies globally raised $2.3 billion in venture capital across 371 investment rounds, representing a 14.7% decrease in QoQ deal value and a 16.3% decrease in the number of deals. Investors are far more picky and want to engage with serious players, given the jolting market correction.

- Other key tech advancements were in the fields of key management and making the DeFi experience more natural. Noteworthy topics were related to protodank-sharding, account abstraction, multi-party computation and inter blockchain protocols.

- In the DeFi space, Liquid Staking Derivatives (LSDFi's) made headlines as they leveraged on the growing interest in Liquid Staking

We have decoded some of these new Tech & DeFi concepts in visually engaging stories in our series Decoded, do give it a try!

- An extremely thorough survey conducted by the team at Consensys & YouGov in Q2 revealed quite some interesting stats about the perception of Web3 in the global landscape; here are the key highlights.

- Strong Crypto Awareness - Over 92% of the 15k surveyors demonstrated awareness of crypto

- Crypto Ownership - Over 20% of participants owned some form of crypto, and over 57% believed it was an eco-friendly tech

- Entry Barriers - Volatility + Fear of Scams was the highest barrier, closely followed by the complexity of the ecosystem and understanding its purpose and use cases.

- Nigeria (65%) and Argentina (56%) show the highest motivation to own cryptocurrencies as a means to store value, given the instability of their local currencies; India (43%) considers it as an investment for the future.

- A major development was when the SEC in the U.S. filed Lawsuits against the industry OGs Coinbase and Binance on account of selling unregistered securities. More updates on this in Q3.

- Another big development was when the world's largest asset-managing fund house, BlackRock, announced that it was filing for a spot Bitcoin ETF, suddenly shifting the market sentiment into a bullish trend with a lot of traditional managers now wanting to jump on the bandwagon. More updates on this in Q3.

Q3 ‘23

- Web3 games have generated 23x more transactions than DeFi and can become one of the most important entry points for new users; Q3 saw Web3 gaming projects secure $600 million, pushing 2023 total investments to $2.3 billion.

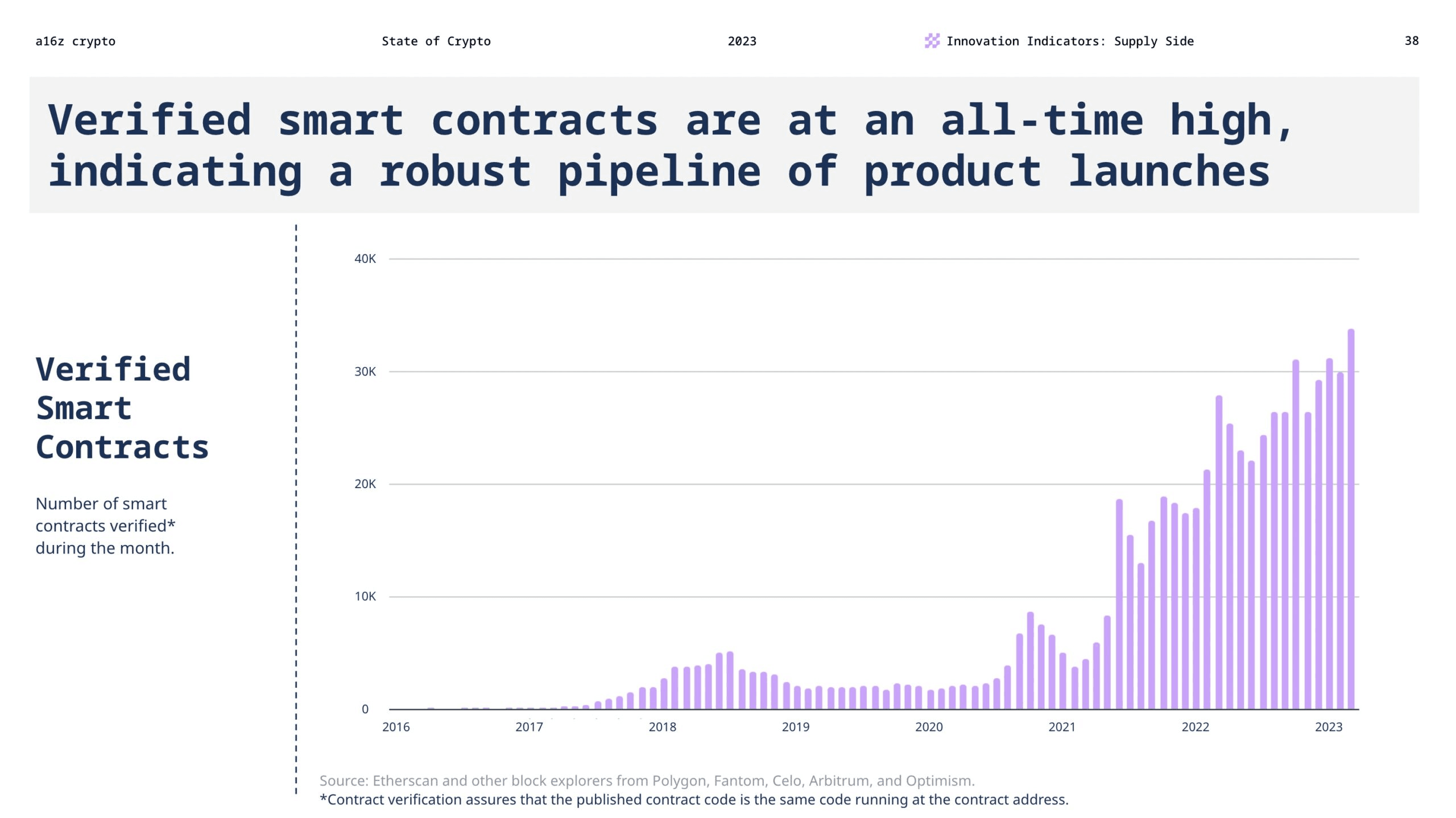

- Both developer activity and the number of smart contracts that are being verified on the chain have been on the increase, which is an extremely good indicator of new product launches, growth, and general interest.

A visual representation of the active number of verified smart contracts / Image: The state of crypto by a16z crypto

- Another serious metric to measure the industry is the number of academic publications in the industry, and we've seen a rise in this, too, as more and more academia seem to be publishing papers on subject matters and tech advancements

- The average number of daily Unique Active Wallets (dUAW) interacting with decentralized applications surged 15% from Q2 2023, reaching an average of 2.2 million dUAW.

- Companies building in the broad Web3 categories have dominated V.C. deal counts, while companies specifically in the Trading category raised the total capital. Interest in A.I. demanded the creation of a new sector, focusing on the overlap between A.I. and crypto.

- While US-based crypto startups accounted for more than 35% of all deals completed and raised more than 34% of the capital invested by V.C. firms, the U.S. is now notably losing share on both deals and capital to countries like the United Arab Emirates, Singapore, and the U.K., all of which have more progressive crypto regulatory frameworks.

With more than $699 million lost across 184 security incidents, Q3 has been 2023's most eventful quarter security-wise.

- For reference, Q1 saw a total of $320 million lost and Q2 $313 million, meaning Q3's losses eclipse those throughout all of H1 2023.

- North Korea's state-affiliated Lazarus Group is one of the key actors currently exploiting the security space. Private key compromises were the next highest contributing factor.

- As for the allegations charged by the SEC on Binance and Coinbase, the request made to freeze's Binance's U.S. assets was rejected by the court and the latest update is that Coinbase will respond to the SEC on Oct 24th having filed a motion to dismiss their case.

- A social media rumor claiming that the SEC had approved BlackRock's ETFs rallied Bitcoin and other blue-chips instantly, and when BlackRock denied this news, nearly $100M of short trading positions were liquidated in 24 hours. Despite this, the global crypto market cap currently stands at $1.06 trillion (as of Oct 16th), reflecting an increase of 0.89% in the past 24 hours, which is great news for the market as a whole.

And that's about it! You're now upto speed with all the biggest noteworthy updates of the year!

End note

Though 2023 was slow and bearish for the greater part, a major outcome was the disappearance of all the gimmicky products that had plagued the industry. With investors being on the edge and keeping a tight check on their purse strings, only serious builders now have the runway to sustain.

A much-needed correction coupled with a global recession has currently put the surface of Web3 on a standstill (of course, lots of ongoing micro-movements remain)

Interestingly, a large part of 2022's market cap loss has been successfully recovered, which can't be said the same for tradfi spaces as the undercurrents are still buzzing with cutting-edge developments, and the potential of the future of the web rests amongst these builders.

References

2023 State of Crypto Report: Introducing the State of Crypto Index - a16z crypto

Web3 Development Report (Q4 2022)

Cryptocurrency Regulation Tracker

Web3 and crypto global survey 2023 | Consensys web3 report

Q2 2023 Crypto Report | PitchBook

2022 Annual Crypto Industry Report | CoinGecko

2023 Q1 Crypto Industry Report | CoinGecko

2023 Q2 Crypto Industry Report | CoinGecko

Crypto & Blockchain Venture Capital

State of the Dapp Industry Q3 2023

Hack3d: The Web3 Security Quarterly Report - Q3 2023 - Blog - Web3 Security Leaderboard

🔑 Key Takeaway

The quarterly insights highlight the continuous growth and innovation within the Web3 ecosystem. While challenges persist, the industry remains resilient and adaptive, positioning itself for an ever-evolving bullish market growth.